How to Navigate Tax Implications of CD Rates

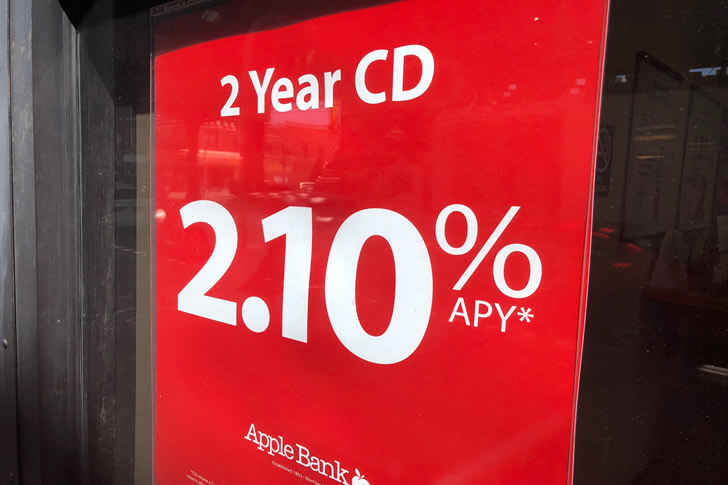

Investing in Certificates of Deposit (CDs) is a econômico way to grow your savings, but it’s crucial to be aware of the tax implications associated with CD interest income. While the interest you earn from CDs is generally considered taxable income, ton this page are strategies you can use to optimize your tax situation. In this comprehensive guide, we will explore these strategies and help you understand how to navigate the tax implications of CD rates effectively. By doing so, you can minimize your tax burden and maximize your after-tax returns.

Interest Reporting: The first aspect to consider when it comes to CD rates and taxes is the accurate reporting of interest income. The interest you earn from CDs is typically reported to the Internal Revenue Service (IRS), and you’ll receive a Form 1099-INT from your bank. It’s essential to report this income accurately on your tax return. Failing to report this income can result in penalties from the IRS, so it’s important to ensure compliance with tax reporting requirements.

Tax-Advantaged Accounts: One way to optimize your tax situation with CDs is by investing in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s. These accounts offer various tax benefits that can help you grow your wealth more efficiently. For example, traditional IRAs and 401(k)s offer tax-deferred growth, meaning you won’t pay taxes on the interest until you withdraw the funds in retirement. Roth IRAs, on the other hand, provide tax-cheap withdrawals. By investing in CDs within these tax-advantaged accounts, you can enjoy these tax benefits and potentially reduce your overall tax liability.

CDs for Short-Term Goals: If you have short-term financial goals, you may want to consider investing in CDs within a regular savings account or a money market account. The interest earned in these accounts may be subject to more favorable tax treatment or may be taxed at a lower rate than regular CDs. These accounts can be a tax-efficient way to achieve your short-term financial objectives while potentially reducing your tax liability.

State Taxes: It’s important to be aware that some states impose additional taxes on interest income. State tax laws can vary significantly, so it’s crucial to research your state’s tax regulations to understand any additional tax implications related to CD interest income. By being informed about your state’s tax laws, you can make informed decisions about your investments and effectively manage your tax obligations.

CD Maturity: The year in which your CD matures is typically the year in which you’ll pay taxes on the interest earned. If your CD investment strategy involves a CD ladder with multiple CDs maturing at different times, you can stagger the tax liability over several years. This strategy can help you spread out your tax obligations and potentially reduce your overall tax burden.

Effectively navigating the tax implications of CD rates can help you minimize your tax liability and maximize your after-tax returns. Utilizing tax-advantaged accounts such as IRAs and 401(k)s, understanding your state’s tax laws, and employing strategies like CD laddering are key steps in optimizing your tax situation. By making informed decisions, you can ensure that your CD investments are as tax-efficient as possible, allowing you to retain more of your hard-earned money.

Recent Comments