Guide to Getting Quick Loans with Bad Credit

In 2024, India’s instant-approval personal loans landscape offers quick, minimal scrutiny options without needing income proof, with loan amounts available up to ₹50 Lakh. This guide helps you secure the best loan you want, even with bad credit.

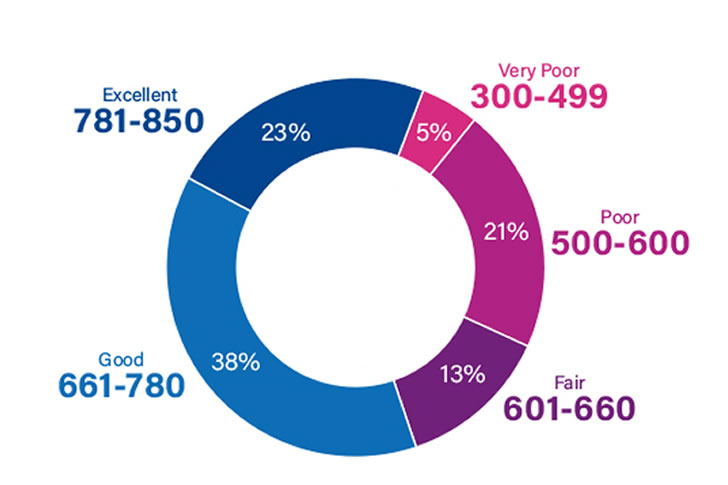

Understanding Credit Scores

A credit score in India ranges from 300 to 900, with scores 650 typically considered poor. This score is a critical factor for lenders to assess your creditworthiness. According to the Reserve Bank of India (RBI), about 79% of loans approved in 2022 were for individuals with a credit score above 750. Having a lower score doesn’t make securing a loan impossible, but it does mean you might face higher interest rates and stricter loan terms.

Factors Affecting Your Credit Score:

- Repayment history: Late payments can severely impact your score.

- Credit utilization ratio: High utilization can indicate dependency on credit and decrease your score.

- Type of credit: A mix of secured and unsecured loans is favorable.

- Credit inquiries: Frequent inquiries can imply financial stress.

Options for Quick Loans with Bad Credit

1. Secured Loans

These loans require you to provide collateral, such as gold, property, or vehicles. They are easier to obtain with bad credit because the lender has a safety net. Major banks and NBFCs (Non-Banking Financial Companies) offer gold loans at interest rates starting as low as 7% annually, depending on the current gold prices and loan terms.

2. Payday Loans

These are short-term loans that you typically need to repay by your next payday. Although they come with high interest rates—sometimes as high as 2% per day—they can be a quick source of funds for emergency situations. They require minimal documentation and are quickly processed.

3. Peer-to-Peer (P2P) Lending

P2P lending platforms in India, like Faircent and Lendbox, connect borrowers with individual lenders. They are less stringent about credit scores but may require more detailed information about your financial health. Interest rates vary widely based on your risk profile and the platform’s policies.

4. Microfinance Institutions (MFIs)

MFIs provide small amount loans to those in lower-income groups and with poor credit scores. According to data from Sa-Dhan (an association of MFIs), the average interest rate offered by MFIs in India was around 20% in 2022. While higher than conventional bank loans, these rates are lower than many high-cost personal loans.

5. NBFCs Loans

In India, some Non-Banking Financial Companies (NBFCs) offer loans without requiring proof of income. These are especially useful for self-employed individuals who may lack formal income documentation. Instead, NBFCs assess creditworthiness based on credit history, banking transactions, and existing liabilities. Loans often come with higher interest rates and stricter terms to mitigate lending risks.

How To Find Low Interest Loan

In India, finding a low-interest loan requires comparing offers from various banks and Non-Banking Financial Companies (NBFCs). Key steps include checking eligibility criteria, reviewing loan terms, and considering secured options like home or gold loans which typically offer lower rates. Utilizing online comparison tools can simplify this process, allowing you to efficiently identify the most competitive rates tailored to your financial situation.

Comparison of Top Loan Providers in India

| Loan Provider | Interest Rate (p.a.) | Loan Limit (INR) | Highlights |

|---|---|---|---|

| SBI (State Bank of India) | 8.5% – 16% | Up to 50 Lakhs | Wide branch network, low processing fees |

| HDFC Bank | 9% – 20% | Up to 40 Lakhs | Quick disbursement, minimal paperwork |

| ICICI Bank | 10.5% – 19% | Up to 25 Lakhs | Attractive rates for existing customers |

| Axis Bank | 10% – 18% | Up to 15 Lakhs | Customizable EMI options |

| Kotak Mahindra Bank | 10.25% – 17% | Up to 20 Lakhs | Fast processing online |

| Bajaj Finserv | 12% – 16% | Up to 25 Lakhs | Offers flexible repayment tenures |

| Tata Capital | 11% – 18% | Up to 30 Lakhs | Minimal documentation required |

| Punjab National Bank | 8.95% – 14% | Up to 20 Lakhs | Lower interest rates for women borrowers |

| IDFC First Bank | 11.5% – 19% | Up to 40 Lakhs | Competitive rates for high-value loans |

| Muthoot Finance | 12% – 26% | Up to 10 Lakhs | Specializes in gold and property-backed loans |

Q&A Section

Q1: What should I consider before applying for a loan with bad credit?

- Assess the necessity of the loan versus the cost, particularly the interest rates and fees.

Q2: How can I improve my chances of getting a loan with bad credit?

- Opt for secured loans, use a co-applicant, and provide proof of stable income.

Q3: Are there any government schemes for people with bad credit?

- Yes, schemes like Pradhan Mantri Mudra Yojana (PMMY) offer business loans to individuals without focusing strictly on credit scores.

Regional Analysis

- Delhi: Known for competitive rates due to the high number of banks and NBFCs operating in the area. Average rates hover around 10%.

- Punjab: Agricultural income influences loan offerings with some banks providing special terms for farmers, rates averaging 12%.

- Mumbai, Maharashtra: The financial hub offers some of the lowest interest rates, starting from 9%, due to intense competition among lenders.

- Gujarat: Known for its business-friendly environment, Gujarat sees a variety of loan products geared towards entrepreneurs, with rates typically around 11%.

- Bangalore, Karnataka: A tech city with a high demand for personal loans, especially from IT professionals. Interest rates start from 10%.

- Hyderabad, Telangana: With a mix of traditional industries and tech companies, Hyderabad offers diverse loan options with interest rates generally around 10-12%.

- Chennai, Tamil Nadu: Focuses on conservative lending with slightly higher rates, generally 11-13%.

- Kolkata, West Bengal: The cultural capital has a steady demand for personal loans with average rates at about 12%.

- Odisha: Reflecting a growing economy, Odisha offers competitive loan options with an average interest rate of 11%.

- Madhya Pradesh: Interest rates here average higher, around 13%, reflecting the varied economic activities from agriculture to mining.

Tips for Managing Loans with Bad Credit

- Be cautious of the debt trap: High-interest rates can quickly lead to debt accumulation. Borrow only what you need and ensure you have a repayment plan in place.

- Understand the terms: Read the fine print. Be aware of any additional charges, such as processing fees or prepayment penalties.

- Prioritize repayment: Paying off loans on time can improve your credit score over time, which will help you secure better borrowing terms in the future.

Conclusion

Securing a quick loan with bad credit in India requires careful planning and consideration of the options available. By leveraging assets as collateral, exploring alternative lending platforms, or utilizing microfinance options, you can find a solution that fits your needs. Always prioritize transparent and sustainable borrowing to improve your financial health and creditworthiness.

References

Recent Comments