Guide to Getting Quick Loans with Bad Credit

In 2024, Nigeria’s instant-approval personal loans landscape provides fast, minimal scrutiny options without requiring proof of income, with loan amounts available up to ₦100 million. This guide helps you secure the best loan you want, even with bad credit.

Understanding Bad Credit

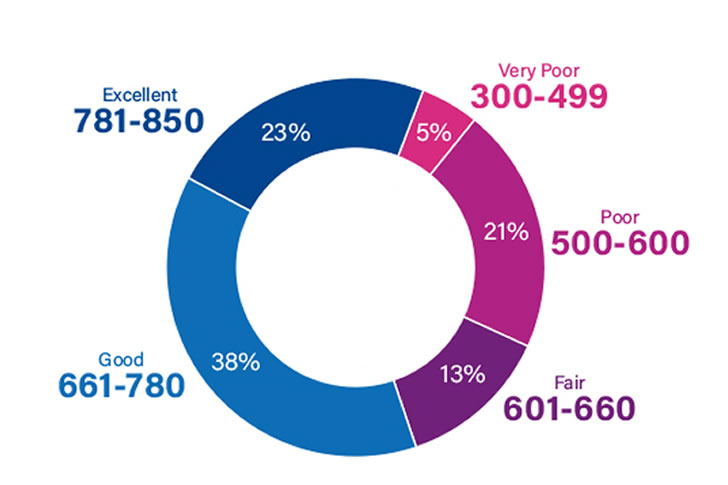

Bad credit refers to a low credit score, often a result of past failures to make timely payments or manage credit effectively. In Nigeria, credit scores typically range from 300 to 850, with scores 580 considered poor. This can make obtaining traditional loans challenging, but not impossible.

Factors Affecting Your Credit Score:

- Repayment history: Late payments can severely impact your score.

- Credit utilization ratio: High utilization can indicate dependency on credit and decrease your score.

- Type of credit: A mix of secured and unsecured loans is favorable.

- Credit inquiries: Frequent inquiries can imply financial stress.

Options for Quick Loans with Bad Credit

In Nigeria, instant approval loans have become increasingly popular due to their rapid processing times and minimal documentation requirements. These loans, frequently provided by digital lenders and fintech companies, are designed to meet urgent financial needs, offering access to funds within hours of application.

1. Microfinance Banks

Microfinance banks in Nigeria specialize in small loans, particularly for individuals with less-than-perfect credit. These institutions are more flexible than commercial banks. For instance, LAPO Microfinance Bank, with branches in Lagos, Abuja, and Port Harcourt, offers quick loans without stringent credit checks.

2. Online Lenders

Digital platforms have revolutionized lending in Nigeria. Companies like Carbon and FairMoney provide quick loans via mobile apps, with minimal documentation and no collateral. These services are available in major cities such as Kano, Ibadan, and Enugu, making them a convenient choice for many Nigerians.

3. Credit Unions

Credit unions are member-owned financial cooperatives that often provide more lenient lending criteria than banks. In Nigeria, local credit unions can be found in places like Kaduna, Abeokuta, and Jos. They offer personalized services, which can be beneficial for individuals with bad credit.

4. Peer-to-Peer Lending

Platforms like FINT and QuickCheck enable peer-to-peer lending, where individuals borrow from others without a traditional financial intermediary. Available in cities such as Benin City, Owerri, and Calabar, these platforms assess risk differently, potentially benefiting those with bad credit.

5. Loan Apps

Numerous mobile apps in Nigeria offer instant loans without requiring proof of income, instead assessing your creditworthiness through algorithmic evaluations. Examples include Branch and PalmCredit, operating extensively in regions like Sokoto, Maiduguri, and Ilorin. These apps require only an internet connection and basic documentation.

How To Find Low Interest Loan

To find a low-interest loan in Nigeria, start by comparing rates from traditional banks like Zenith and GTBank, as well as digital lenders. Use online comparison tools specific to Nigeria to quickly identify the best rates based on your financial needs. Watch for special deals during promotional periods, which may offer lower rates. Always review all loan terms, including any additional fees or penalties, to ensure you’re choosing the most cost-effective option.

Comparison of Top Loan Providers in Nigeria

| Loan Provider | Interest Rate (%) | Loan Amount (₦) | Highlights |

|---|---|---|---|

| GTBank | 15-20 | 50,000 – 10,000,000 | Flexible terms, wide coverage |

| Zenith Bank | 12-18 | 20,000 – 5,000,000 | Lowest rates for salary earners |

| Access Bank | 13-19 | 50,000 – 5,000,000 | Quick access, multiple products |

| UBA | 12-20 | 50,000 – 10,000,000 | Pan-African reach, reliable |

| First Bank | 10-16 | 100,000 – 10,000,000 | Long-standing bank, high limits |

| Carbon | 5-15 | 1,500 – 1,000,000 | Instant approval, minimal requirements |

| FairMoney | 10-30 | 2,000 – 500,000 | Flexible repayments, no collateral |

| Branch | 15-34 | 1,000 – 200,000 | Easy app use, fast funding |

| PalmCredit | 20-36 | 2,000 – 100,000 | Zero paperwork, rapid processing |

| Aella Credit | 4-29 | 5,000 – 1,000,000 | Innovative scoring, wide reach |

Q&A Section

Q1: What should I consider before applying for a loan with bad credit?

- Assess the necessity of the loan versus the cost, particularly the interest rates and fees.

Q2: How can I improve my chances of getting a loan with bad credit?

- Opt for secured loans, use a co-applicant, and provide proof of stable income.

Q3: Will taking out a bad credit loan affect my credit score?

- If managed properly, taking out a loan can actually help improve your credit score by demonstrating responsible credit behavior.

Regional Breakdown of Loan Options

- Lagos: Lagos, being the commercial hub, offers a plethora of options for quick loans. Online lenders like Carbon and FairMoney have a strong presence here, alongside traditional banks and microfinance institutions.

- Abuja: In Abuja, government schemes such as TraderMoni and NIRSAL Microfinance Bank are prominent. Several microfinance banks also cater to civil servants and small businesses.

- Kano: Kano’s economy is driven by agriculture and trade, making microfinance banks like LAPO and cooperative societies essential for quick loan access.

- Port Harcourt: Oil-rich Port Harcourt has a high demand for quick loans, particularly for business ventures. Peer-to-peer platforms like KiaKia and traditional banks offer various loan products.

- Ibadan: Ibadan, with its growing SME sector, benefits from cooperative societies and microfinance banks that provide tailored loan solutions to entrepreneurs.

- Kaduna: Kaduna has several microfinance institutions focusing on agricultural loans and small business funding, crucial for the region’s economy.

- Enugu: In Enugu, online lenders and cooperative societies play a significant role in providing quick loans to individuals with bad credit.

- Benin City: Benin City’s economy benefits from microfinance banks and government initiatives targeting small traders and artisans.

- Jos: Jos has a thriving agricultural sector supported by microfinance banks offering loans for farming and related activities.

- Maiduguri: Despite security challenges, Maiduguri has cooperative societies and microfinance banks supporting local businesses with quick loan options.

Tips for Managing a Loan with Bad Credit

- Make Timely Payments: Avoid fees and further damage to your credit score by ensuring you pay on time.

- Borrow Only What You Need: Over-borrowing can lead to debt accumulation, which is particularly risky with a bad credit background.

- Improve Your Credit Score: Use this loan as an opportunity to build your credit. Consistent, timely payments can improve your score significantly.

Conclusion

Securing a quick loan with bad credit in Nigeria requires careful planning and consideration of various options. By understanding your needs, researching available lenders, and managing loans responsibly, you can navigate the financial challenges that come with a low credit score. Whether you’re in Lagos, Abuja, or a smaller locale like Gombe, the right approach can open up numerous possibilities to secure funding when you need it most.

References

Recent Comments