Guide to Finding Financing for Used Cars in the UK

Navigating car financing in the UK can be challenging but rewarding.

Understanding Used Car Financing in the UK

Financing a used car in the UK involves several options, including bank loans, dealership financing, and online lenders. Each option offers different advantages depending on your financial situation and the type of car you’re looking to buy.

Key Financing Options:

- Bank Loans: Typically offer lower interest rates.

- Dealership Financing: Convenient but may have higher rates.

- Online Lenders: Flexible terms and often quicker approval processes.

Factors to Consider When Choosing Financing

Choosing the right financing for a used car requires understanding several key factors:

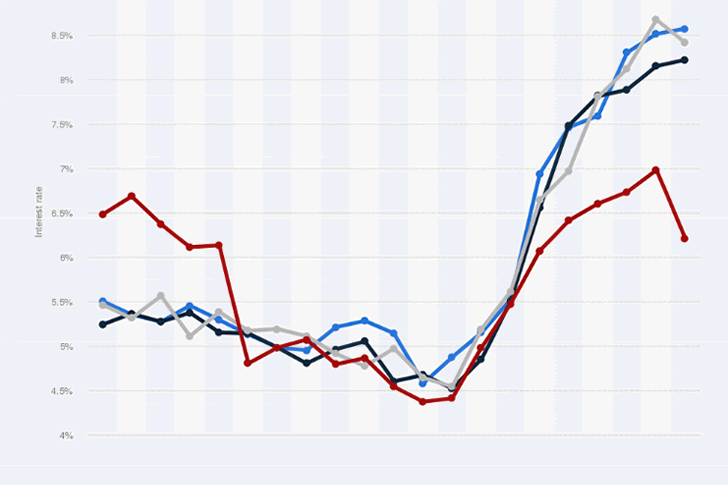

- Interest Rates: Lower rates mean lower overall costs.

- Loan Terms: Longer terms can reduce monthly payments but increase total interest.

- Credit Score Impact: Some financing options require a hard credit check.

Tips for Finding the Best Deals:

- Compare offers from multiple lenders.

- Check for any hidden fees or penalties.

- Consider a substantial down payment to reduce borrowing.

Analyzing the Market with Data

An Excel table can be helpful to compare different financing offers. Here’s an example based on fictional data:

| Lender | Interest Rate | Loan Term | Monthly Payment | Total Cost |

|---|---|---|---|---|

| Barclays Bank | 5.5% | 5 years | £200 | £12,000 |

| Santander UK | 6.0% | 5 years | £205 | £12,300 |

| Nationwide | 4.9% | 5 years | £195 | £11,700 |

| HSBC UK | 5.0% | 5 years | £198 | £11,880 |

| Lloyds Bank | 6.5% | 5 years | £210 | £12,600 |

| NatWest | 5.2% | 5 years | £200 | £12,000 |

| RBS (Royal Bank of Scotland) | 5.7% | 5 years | £202 | £12,120 |

| Halifax | 6.8% | 5 years | £213 | £12,780 |

| Metro Bank | 4.7% | 5 years | £194 | £11,640 |

| Virgin Money | 5.1% | 5 years | £199 | £11,940 |

UK Locations for Car Financing:

London: As the capital city, London offers a vast array of financing options through banks, dealerships, and online platforms, serving a diverse market from economy to luxury vehicles.

Manchester: Known for its vibrant automotive market, Manchester provides competitive car financing solutions, accommodating a range of credit scores.

Birmingham: Birmingham’s large network of dealerships offers numerous financing deals, especially on used cars, catering to both central and suburban consumers.

Leeds: In Leeds, potential car buyers can find favorable loan terms, thanks to a competitive local banking sector focused on consumer financing.

Glasgow: Scotland’s largest city offers robust financing options through both traditional banks and specialized car finance companies.

Liverpool: This city is known for its straightforward car financing processes, with many dealerships offering in-house financing that simplifies the purchase of used cars.

Bristol: Bristol’s car financing scene is bolstered by its tech-savvy approach, offering online financing options that often beat traditional rates.

Sheffield: In Sheffield, buyers can explore various financing avenues, including options for those with less than perfect credit histories.

Edinburgh: Edinburgh offers a mix of traditional and innovative financing solutions, reflecting its status as a financial hub in Scotland.

Cardiff: The capital of Wales provides a range of car financing options, particularly through credit unions and local banks that often have lower interest rates.

Frequently Asked Questions

Q: What credit score is needed for good financing rates? A: Typically, a score above 700 is considered good.

Q: Can I finance a used car with no down payment? A: Yes, some lenders offer zero down payment, but this may result in higher monthly payments.

Q: Are there specific loans for older used cars? A: Yes, some lenders specialize in loans for older models, though terms may vary.

Conclusion

Finding the right financing for a used car in the UK requires careful comparison and understanding of terms and conditions. With the right approach, you can secure a deal that fits your budget and meets your needs.

References for Further Information:

This guide aims to equip you with the knowledge to navigate the complexities of car financing in the UK, ensuring you make informed decisions when purchasing a used car.

Recent Comments